Although global hotel deal volume is projected to remain in line with the most recent three-year average in 2013, Jones Lang LaSalle’s Hotels & Hospitality Group believes that signs point to an on-going uptick in Americas hotel transactions activity sooner rather than later. Jones Lang LaSalle revealed five forces which will drive the hotel investment market during the next five years at the Americas Lodging Investment Summit (ALIS) recently at the J.W. Marriott L.A. LIVE.

“There will be a significant amount of property coming to market in 2013 from a combination of the de-leveraging occurring as $55 billion of CMBS matures in the next few years and we’ll see investors who bought earlier in the cycle want their capital gains and they’ll sell,” said Arthur Adler, Americas CEO of Jones Lang LaSalle’s Hotels & Hospitality Group. “You can’t underestimate the composition of hotel ownership over a long period of time as many hotels today are in the hands of traders versus holders.”

Investors should watch the following five key forces and their impact on the hotel market:

1. Boom or bust?: Global deal volume is projected to reach as high as $33 billion this year, in line with the most recent three-year average, and could rise to $50 billion to $70 billion in the medium term. Foreign investors, primarily groups from Asia and the Middle East, have already put $3.2 billion in off-shore capital into hotels in the United States since 2010 and aren’t expected to slow down in the coming years.

2. Hotel transaction level drivers: The United States will account for half the global deal activity as fundamentals remain strong. Improving industry fundamentals, the availability and cost of capital, REIT stock prices, the amount of product on the market and the composition of hotel ownership all have a significant impact on transactions volume and will continue to drive growth.

3. Cash is king, but debt is on its way back: The formidable return of the CMBS market last year improved pricing and terms for borrowers, while drawing other lenders into the hospitality arena. Debt availability should reach a six-year high as domestic and offshore banks, insurance companies, debt funds and mortgage REITs will augment the increased CMBS lending.

4. Increasing the value of a hotel: As top-line revenue rebounds, owners will fight to avoid profit erosion and maintain asset value through increased emphasis on more dynamic and efficient revenue management and analytical tools. Increasing competition for traveler loyalty and third-party travel agents will challenge operators and come at a cost. Hotels will need to invest more in digital marketing efforts and leverage the use of online travel agencies as part of a diversified distribution channel strategy.

5. Let the games begin in Latin America: Economies in Latin America are expected to grow by four percent annually through 2020 and the region’s share of global GDP is slated to increase by 25 percent from 2000 to 2020. Economic reforms, growth in income per capita stemming from increased economic decentralization in several key markets and events such as the 2014 FIFA Soccer World Cup and Summer Olympic Games in Brazil will make the region attractive for growth in the lodging sector. Brazil, Mexico, Colombia, Peru and Chile will be at the forefront of the increase.

As operating fundamentals remain strong, hotels should remain a favored asset class globally among lenders, institutional and offshore investors. With debt simultaneously becoming more available and competitively priced, asset values and transaction volume should continue to rise.

About Jones Lang LaSalle's Hotels & Hospitality Group

Jones Lang LaSalle’s Hotels & Hospitality Group serves as the hospitality industry’s global leader in real estate services for luxury, upscale, select service and budget hotels; timeshare and fractional ownership properties; convention centers; mixed-use developments and other hospitality properties. The firm’s more than 265 dedicated hotel and hospitality experts partner with investors and owner/operators around the globe to support and shape investment strategies that deliver maximum value throughout the entire lifecycle of an asset. In the last five years, the team completed more transactions than any other hotels and hospitality real estate advisor in the world totaling nearly US$25 billion, while also completing approximately 4,000 advisory and valuation assignments. The group’s hotels and hospitality specialists provide independent and expert advice to clients, backed by industry-leading research.

For more news, videos and research from Jones Lang LaSalle’s Hotels & Hospitality Group, please visit: www.jll.com/hospitality or download the Hotels & Hospitality Group’s app from the App Store.

About Jones Lang LaSalle

Jones Lang LaSalle (NYSE:JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual revenue of $3.9 billion, Jones Lang LaSalle operates in 70 countries from more than 1,000 locations worldwide. On behalf of its clients, the firm provides management and real estate outsourcing services to a property portfolio of 2.6 billion square feet. Its investment management business, LaSalle Investment Management, has $47.0 billion of real estate assets under management. For further information, visit www.jll.com.

Related Stories

| Oct 17, 2011

THOUGHT LEADER: Allan Bilka, Senior Staff Architect and Secretariat to the IGCC

Allan Bilka, RA, is a Senior Staff Architect and Secretariat to the International Green Construction Code (IgCC) with the International Code Council, based in the ICC’s Chicago district office. He also serves as staff liaison to the ICC-700 National Green Building Standard. He has written several ICC white papers on green building and numerous green-related articles for the ICC. A registered architect, Bilka has over 30 years of combined residential design/build and commercial consulting engineering experience.

| Oct 17, 2011

Austin's newest urban apartment complex under construction

Complex sits on a four-acre waterfront site along Lady Bird Lake with spectacular city and lake views, and is slated to open spring 2013.

| Oct 17, 2011

Aerialogics announces technology partnership with CertainTeed Corp.

CertainTeed to provide Aerialogics’ Aerial Measurement Services to its credentialed contractor base and utilize the technology in its Roofing Products Division.

| Oct 17, 2011

Big D Floor covering supplies to offer Johnsonite Products??

Strategic partnership expands offering to south and west coast customers.

| Oct 17, 2011

Clery Act report reveals community colleges lacking integrated mass notification systems

“Detailed Analysis of U.S. College and University Annual Clery Act Reports” study now available.

| Oct 17, 2011

USGBC L.A. Chapter's Green Gala to feature Jason McLennan as keynote speaker

Chapter to presents inaugural Sustainable Innovation Awards,

| Oct 17, 2011

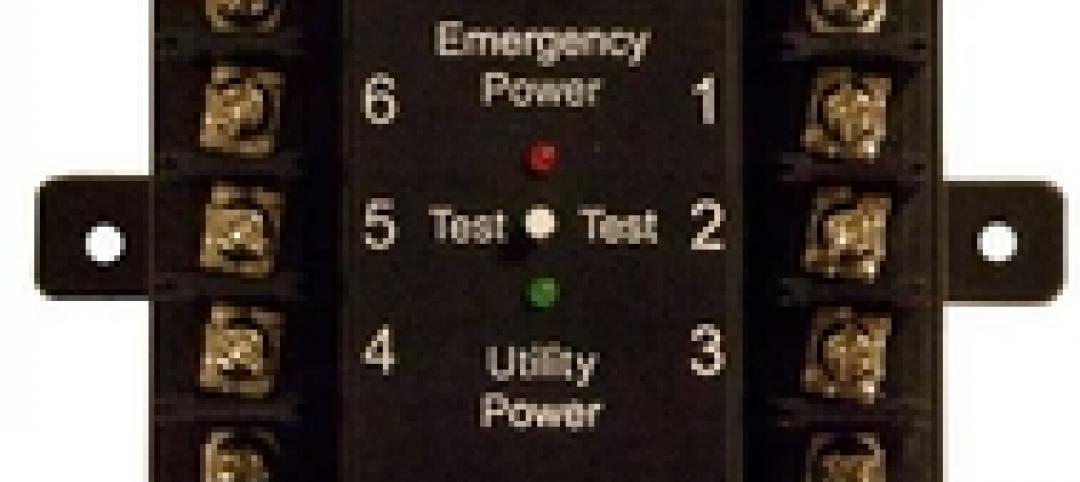

Schneider Electric introduces UL924 emergency lighting control devices

The emergency lighting control devices require fewer maintenance costs and testing requirements than backup batteries because they comply with the UL924 standard, reducing installation time.

| Oct 14, 2011

AISC develops new interoperability strategy to move construction industry forward

AISC is working to bring that vision to reality by developing a three-step interoperability strategy to evaluate data exchanges and integrate structural steel information into buildingSMART's Industry Foundation Classes.

| Oct 14, 2011

University of New Mexico Science & Math Learning Center attains LEED for Schools Gold

Van H. Gilbert architects enhances sustainability credentials.

| Oct 14, 2011

BD+C Survey on Building Information Modeling: The Good, the Bad, and the Solutions

In a recent survey conducted by Building Design+Construction, more than 75% of respondents indicated they currently use BIM or plan to use it. Respondents were also asked to comment on their experiences with BIM, what they liked and disliked about BIM, and what BIM-related advice they would give to their peers.