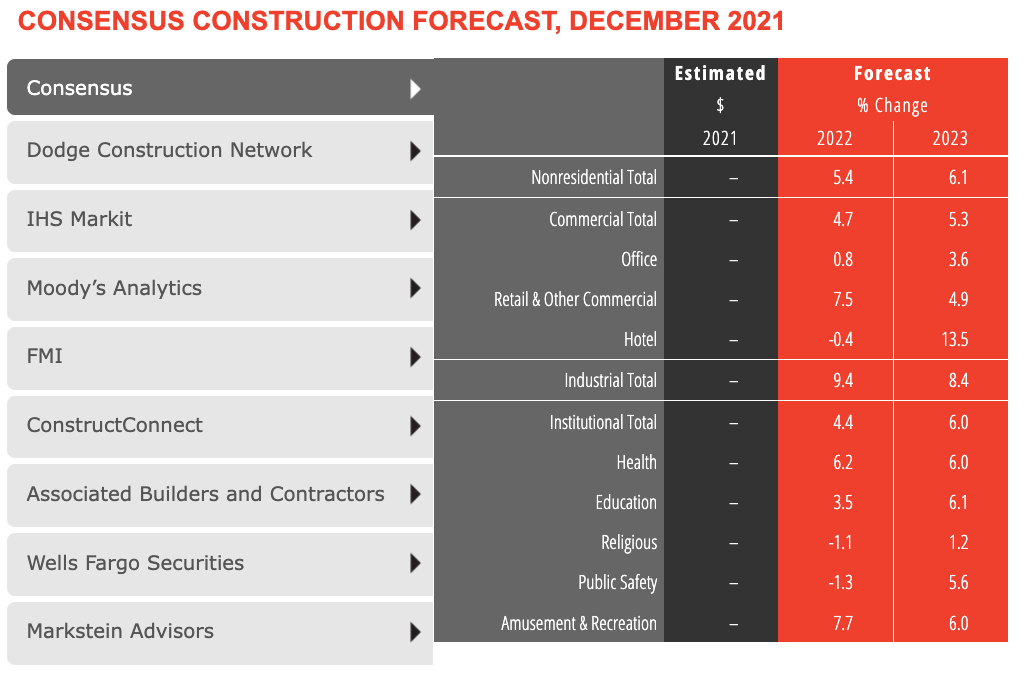

According to a new report from the American Institute of Architects, the nonresidential building sector is expected to see a healthy rebound through next year after failing to recover with the broader economy last year.

The AIA’s Consensus Construction Forecast panel—comprising leading economic forecasters—expects spending on nonresidential building construction to increase by 5.4 percent in 2022, and accelerate to an additional 6.1 percent increase in 2023. With a five percent decline in construction spending on buildings last year, only retail and other commercial, industrial, and health care facilities managed spending increases.

This year, only the hotel, religious, and public safety sectors are expected to continue to decline. By 2023, all the major commercial, industrial, and institutional categories are projected to see at least reasonably healthy gains.

“The pandemic, supply chain disruptions, growing inflation, labor shortages, and the potential passage of all or part of the Build Back Better legislation could have a dramatic impact on the construction sector this year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Challenges to the economy and the construction industry notwithstanding, the outlook for the nonresidential building market looks promising for this year and next.”

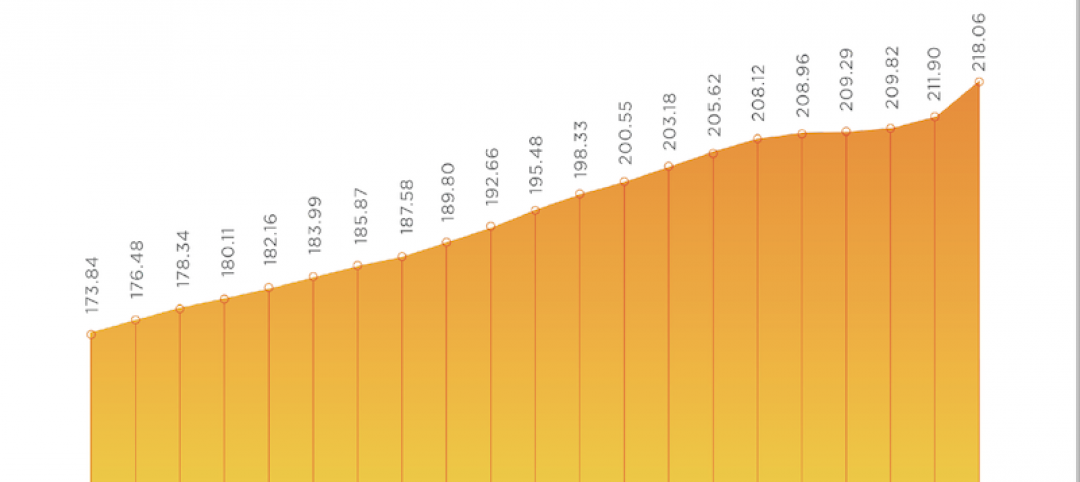

CLICK HERE TO VIEW INTERACTIVE CHART

More from AIA:

- The recovery in the broader economy in 2021 didn’t carry over to the nonresidential building sector. Spending on the construction of these facilities declined about 5%, on top of the 2% decline in 2020.

- The broader economy has seen a solid recovery since the depths of the pandemic-induced recession. It grew by about 5% last year and now has fully recovered from the past recession. There were almost 4 million net new payroll positions added last year, bringing national employment almost back to the level it was at in February 2020 prior to the pandemic. The national unemployment rate was 3.9% at the end of last year, just above the 3.5% rate in February 2020.

- In spite of these positive economic indicators, there are several headwinds to future economic growth. The uncertainty surrounding combatting Covid and its variants have added tremendous uncertainty to future building needs. The Biden Administration’s Build Back Better program was slated to add significant support to the construction sector, but its funding is very much in doubt at present (January 2022). Supply chain disruptions are likely to continue slow economic growth well into this year. Inflation accelerated during the second half of last year to its highest rate in almost four decades, which is expected to put upward pressure on interest rates. Finally, the already-serious labor shortages look to become even more severe this year and next.

- Industries throughout the economy are finding it challenging to retain their current employees and are having difficulty recruiting new ones. Most workers feel that jobs are plentiful, and therefore are increasingly comfortable leaving their current job in favor of searching for a better one. A recent survey of architecture firm leaders found that more than four in ten feel that recruiting architectural staff is a serious problem at present, and that it may create difficulties for the firm over the coming months given anticipated project workloads.

Related Stories

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.

Market Data | Jun 16, 2021

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.