Last year’s boon in single-family housing construction will have an impact on the availability and cost of building materials for nonresidential construction in 2021, which is expected to be a year of “decreasing work volume,” according to JLL’s latest Construction Forecast being released today.

Nonresidential starts were down 24% last year, and are expected to decline again in 2021. Yet, JLL sees an industry that has become more resilient and better positioned to function during the pandemic recovery.

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

This recovery won’t be like the last one during the Great Recession in the late 2000s. For one thing, the range between sector forecasts is wider.

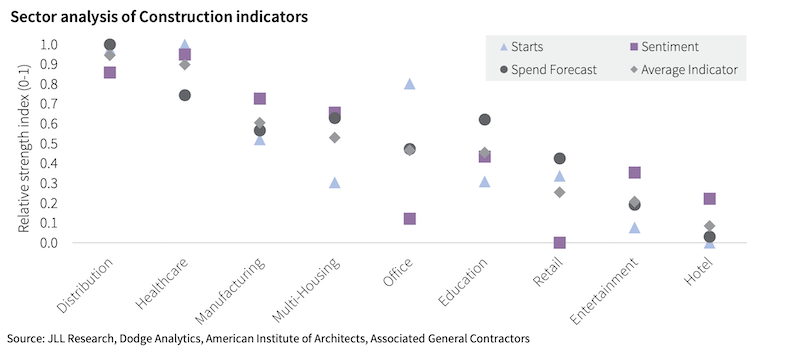

JLL analyzed three indicators of future growth: construction starts, construction industry sentiment, and forecast construction spending across nine nonresidential sectors. The clear winners, in its estimation, will be distribution and healthcare. The clear stragglers: hotels and entertainment. The office sector shows the least consensus.

LUMBER PRICING WILL CONTINUE TO BE VOLATILE

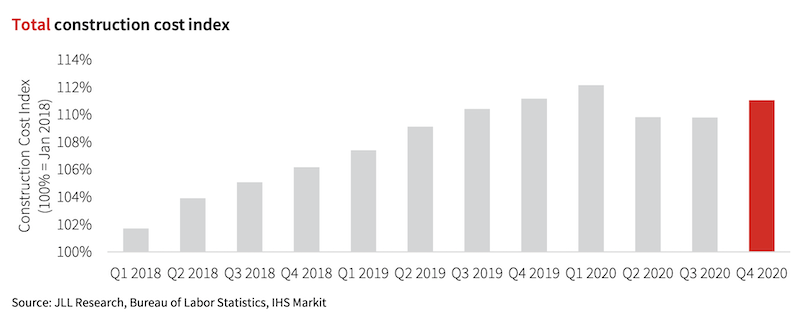

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

In addition, this has not been a total construction shutdown. Single-family housing starts increased by 11% last year, and have continued to grow since last May. (According to the latest Census Bureau estimates, single-family starts in January, at an annualized rate of 1,269,000 units, were up 29.9% over the same month in 2020.)

Residential construction employment was also up last year, by 1.2%, while nonres construction employment dipped 3.9%. That growth is affecting labor and materials markets. “The growth in residential is the primary cause of our forecast for elevated cost inflation in the coming year,” states JLL.

This year, it predicts that construction cost increases will be in the higher range between 3.5% and 5.5%. Labor costs will be up in the 2-5% range. Material costs will rise 4-6% and volatility “will remain elevated.” Nonres construction spending will stabilize from the early stages of the pandemic, but still decline between 5% and 8%, although JLL foresees an upswing in the third and fourth quarter, and more typical industry growth in 2022.

One silver lining from the pandemic is that it “spurred three years of construction tech adoption to be condensed into the last nine months of 2020,” observes JLL. It cites a recent Associated General Contractors survey that found contractors planning to increase their spending for all 14 ConTech categories listed.

Labor demand should also continue, although the key to any construction recovery, states JLL, will be how quickly the population is vaccinated against COVID-19. The industry’s labor shortage was a big enough buffer to absorb some of the pandemic’s shock, and through the entire post-pandemic period “there have been more active job openings in construction than at the peak of the last expansion in 2006-2007.”

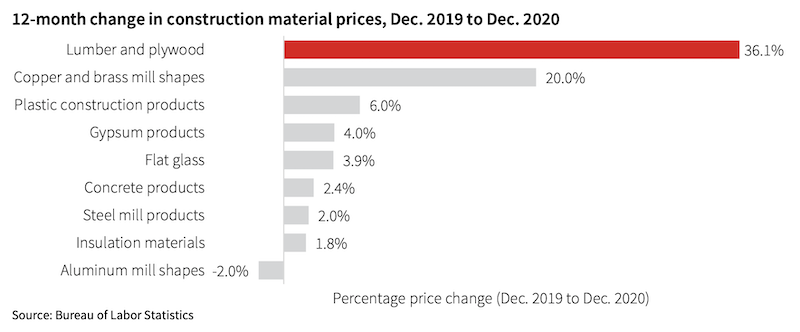

As for materials pricing, volatility will affect lumber, plywood, copper and brass mill shapes. The least volatile, price-wise, should be concrete, flat glass, insulation, and plastic construction products.

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

NEW ADMINISTRATION COULD SHAKE UP CONSTRUCTION

JLL weighed in on the potential impact of the Biden Administration on the construction industry. The next stimulus package, if passed by Congress, should keep the economy’s growth from reversing. A large infrastructure bill “is a good possibility later this year,” which JLL thinks could be an “accelerant” to construction inflation.

Interestingly, JLL doesn’t think either a reduction in immigration restrictions or an increase in the minimum wage to $15 per hour would have a substantive impact on projects, wages, or costs, except in states like Texas where construction wages are lower than the federal rate.

Related Stories

Multifamily Housing | Dec 6, 2022

Austin's new 80-story multifamily tower will be the tallest building in Texas

Recently announced plans for Wilson Tower, a high-rise multifamily building in downtown Austin, Texas, indicate that it will be the state’s tallest building when completed. The 80-floor structure will rise 1,035 feet in height at 410 East 5th Street, close to the 6th Street Entertainment District, Austin Convention Center, and a new downtown light rail station.

Geothermal Technology | Dec 6, 2022

Google spinoff uses pay-as-you-go business model to spur growth in geothermal systems

Dandelion Energy is turning to a pay-as-you-go plan similar to rooftop solar panel leasing to help property owners afford geothermal heat pump systems.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mixed-Use | Dec 6, 2022

Houston developer plans to convert Kevin Roche-designed ConocoPhillips HQ to mixed-use destination

Houston-based Midway, a real estate investment, development, and management firm, plans to redevelop the former ConocoPhillips corporate headquarters site into a mixed-use destination called Watermark District at Woodcreek.

Office Buildings | Dec 5, 2022

How to foster collaboration and inspiration for a workplace culture that does not exist (yet)

A building might not be able to “hack” innovation, but it can create the right conditions to foster connection and innovation, write GBBN's Chad Burke and Zachary Zettler.

University Buildings | Dec 5, 2022

Florida Polytechnic University unveils its Applied Research Center, furthering its mission to provide STEM education

In Lakeland, Fla., located between Orlando and Tampa, Florida Polytechnic University unveiled its new Applied Research Center (ARC). Designed by HOK and built by Skanska, the 90,000-sf academic building houses research and teaching laboratories, student design spaces, conference rooms, and faculty offices—furthering the school’s science, technology, engineering, and mathematics (STEM) mission.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Giants 400 | Dec 1, 2022

Top 50 Parking Structure Architecture + AE Firms for 2022

Choate Parking Consultants, Gensler, Clark Nexsen, and Solomon Cordwell Buenz top the ranking of the nation's largest parking structure architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Education Facilities | Nov 30, 2022

10 ways to achieve therapeutic learning environments

Today’s school should be much more than a place to learn—it should be a nurturing setting that celebrates achievements and responds to the challenges of many different users.

75 Top Building Products | Nov 30, 2022

75 top building products for 2022

Each year, the Building Design+Construction editorial team evaluates the vast universe of new and updated products, materials, and systems for the U.S. building design and construction market. The best-of-the-best products make up our annual 75 Top Products report.